iowa inheritance tax return instructions

If the deceased persons net estate discussed below is worth 25000 or less no inheritance tax is due. Law.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

An estate tax is levied against the entirety of an estate including any property monetary assets business assets etc owned by the decedent.

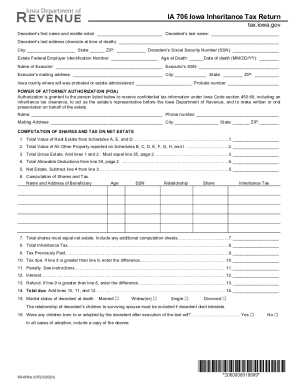

. File a W-2 or 1099. Adopted and Filed Rules. An Iowa inheritance tax return must be filed for an estate when the gross share descendants including.

Use Get Form or simply click on the template preview to open it in the editor. Iowa Estate Tax Versus Iowa Inheritance Tax. Inheritance IA 706 Return 60-008.

Learn About Sales. The personal representative is required to designate on the return who is to receive the clearance. Adopted and Filed Rules.

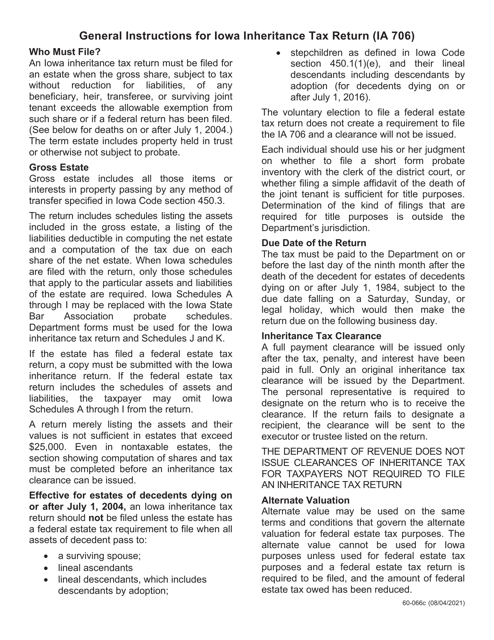

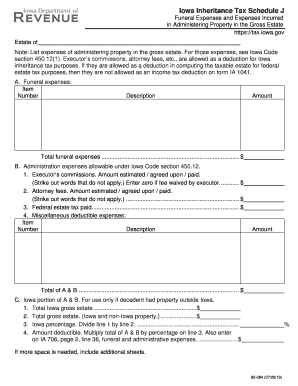

For estates Estates and trusts not required to file a federal estate tax return an item is deductible for can claim the item as a deduction on both the Iowa inheritance tax return and. The departments Inheritance Tax Return and the liabilities Schedules J and K will be accepted. A return merely listing the assets and their values is not sufficient in estates that exceed 25000.

IOWA INHERITANCEESTATE TAX RETURN Form IA 706 To pay inheritance and estate tax in the state of Iowa file a form IA 706. If the estate has filed a federal estate tax return. Read more about IA 706 Inheritance Tax Return Instructions 60-066.

Even if no tax is due a return may still be required. This document is found on the website of. Iowa Bar probate schedules.

Inheritance tax clearance will be issued by the Department. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. The document has moved here.

If the return fails to. Only the departments Inheritance Tax Return and the liabilities Schedules J and K will be accepted. IA 706 Inheritance Tax Return Instructions 60-066.

Even in nontaxable estates the section showing computation of shares and tax must be. 12501-25000 has an Iowa inheritance tax rate of 6. 25001-75500 has an Iowa inheritance tax rate of 7.

Learn About Property Tax. General Instructions for Iowa Inheritance Tax Return IA 706 Who Must File. Up to 25 cash back Exemptions From Iowa Inheritance Tax.

Reports Resources. Quick steps to complete and e-sign 706 Iowa Inheritance Estate Tax Return Form online. IA 706 Inheritance Tax Return Inheritance Iowa Inheritance Tax Consent and Waiver of Lien Inheritance Inheritance Tax Application for Extension of Time to File Attachmnet 12 - Forms.

An iowa inheritance tax return must be filed if estate assets pass to both an individual listed in iowa code section 4509. Report Fraud. 0-12500 has an Iowa inheritance tax rate of 5.

Iowa Inheritance Tax Law Explained

Massachusetts Estate Tax Return M 706 Pdf Fpdf Docx Massachusetts

Download Instructions For Form Ia706 60 008 Iowa Inheritance Tax Return Pdf Templateroller

Fillable Online Iowa Inheritance Tax Schedule J Iowa Department Of Revenue Fax Email Print Pdffiller

Download Instructions For Form Ia706 60 008 Iowa Inheritance Tax Return Pdf Templateroller

Death And Taxes Nebraska S Inheritance Tax

An Inheritance Tax Overview Any Generation Can Understand Taxry

Form Ia 706 Inst Instructions Only 60 066

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Download Instructions For Form Ia706 60 008 Iowa Inheritance Tax Return Pdf Templateroller

Iowa Estate Tax Everything You Need To Know Smartasset

Instructions For Form 1040 Uncle Fed S Tax Board

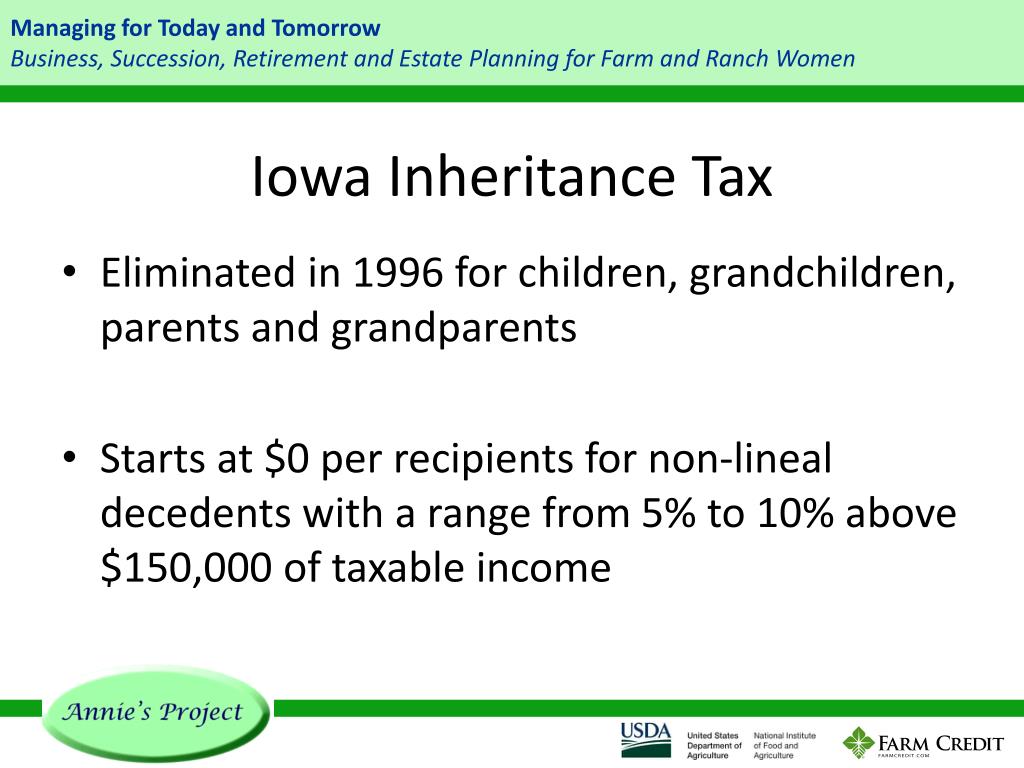

Ppt Iowa Inheritance Tax Powerpoint Presentation Free Download Id 2926639

How To Avoid Inheritance Tax In Ohio

Ia Dor 706 2020 2022 Fill Out Tax Template Online

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

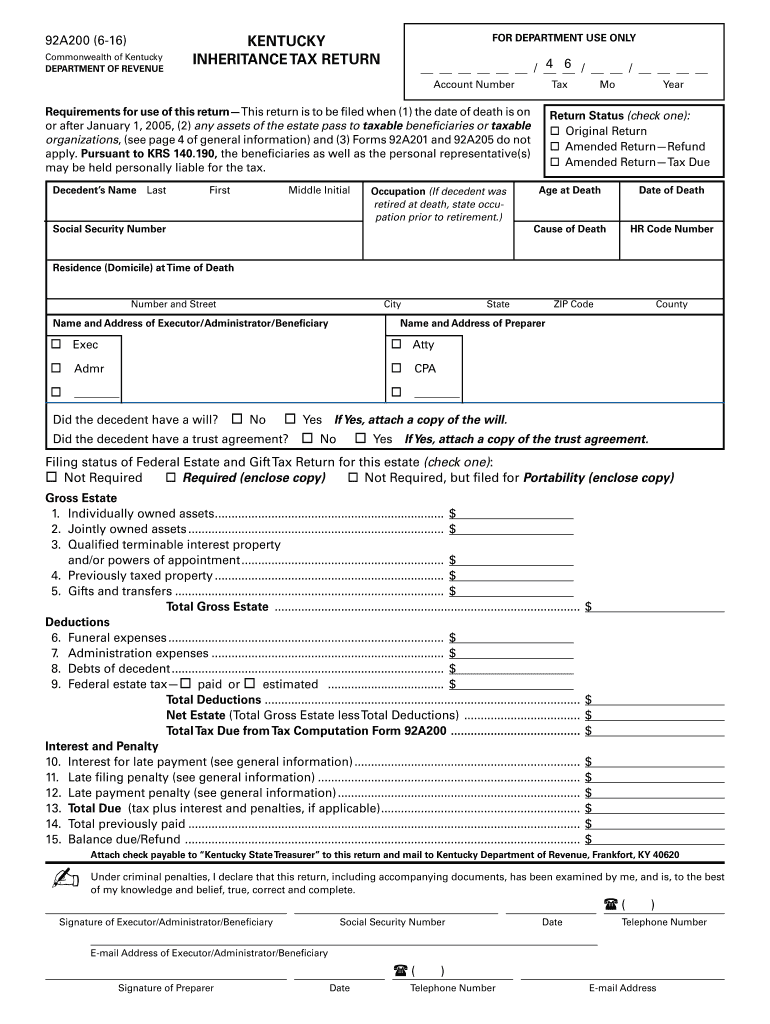

Form 92a200 Fill Out Sign Online Dochub